Errors & Omissions (E&O) insurance is a crucial form of coverage for businesses in Colorado that provide professional services or advice. This type of insurance is essential for professionals such as consultants, architects, real estate agents, and IT service providers, among others. Essentially, any business that offers expertise or services to clients can benefit from E&O insurance. This coverage protects against claims of negligence or inadequate work, which can arise even if the business did not make a mistake. The need for E&O insurance is particularly high in professions where the consequences of an error can result in significant financial loss for a client.

E&O insurance in Colorado covers a range of potential liabilities, including legal defense costs, settlements, and judgments. For instance, if a client alleges that a professional’s advice or service led to financial loss, the insurance policy can cover the legal expenses of defending against the claim. Moreover, if the business is found liable, E&O insurance can cover the cost of the settlement or judgment. This coverage extends to errors, omissions, misrepresentation, and breach of contract, providing a comprehensive safety net for businesses against various risks associated with their professional services.

The importance of E&O insurance cannot be overstated, as it helps safeguard a business’s financial stability and reputation. In Colorado’s competitive market, a lawsuit—even one without merit—can be costly and damaging. E&O insurance not only helps cover the financial costs of legal battles but also demonstrates to clients that the business is committed to professional standards and accountability. By having this coverage, businesses can operate with confidence, knowing they are protected against potential mistakes or misunderstandings that could otherwise have severe financial repercussions.

How Much Does Errors & Omissions Insurance Cost in Colorado?

The cost of Errors & Omissions (E&O) insurance in Colorado varies significantly based on several factors, including the type of business, the size of the company, and the level of risk associated with the professional services offered. Generally, smaller businesses or those in lower-risk professions can expect to pay lower premiums, often ranging from $500 to $1,500 annually. For example, consultants or freelance graphic designers might see premiums on the lower end of this spectrum. On the other hand, businesses in higher-risk professions, such as financial advisors or architects, may face higher premiums due to the greater potential for costly claims, with rates potentially reaching $3,000 or more annually.

The amount of coverage selected also impacts the cost. E&O insurance policies typically offer coverage limits ranging from $250,000 to $2 million or more. Businesses opting for higher coverage limits can expect to pay higher premiums. The deductible chosen—ranging from $1,000 to $10,000—will affect the overall cost, with higher deductibles generally leading to lower premiums. Additionally, factors like the insurer’s underwriting criteria, the business’s claims history, and the specific terms of the policy can influence the final premium. Businesses in Colorado should work closely with local insurance brokers to obtain accurate quotes and tailor coverage to their specific needs and risk profile.

Protect Your Business: Get a E&O Insurance Today!

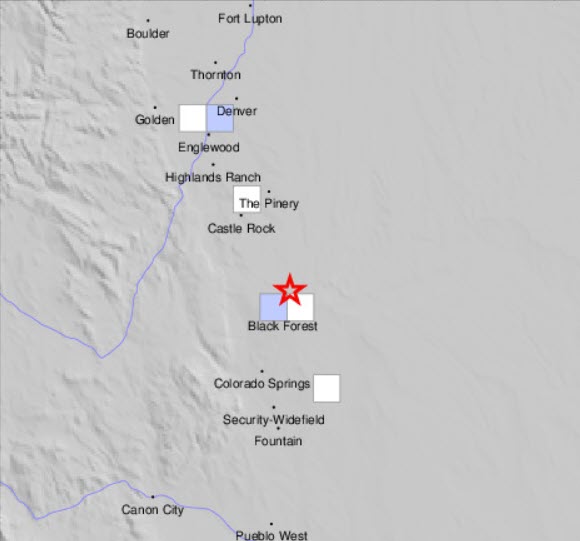

Castle Rock Insurance is highly recommended for Errors & Omissions (E&O) insurance in Colorado due to its access to over 50 commercial insurance carriers. This broad network enables them to tailor coverage plans to the specific needs of various professional services. Their local expertise ensures clients receive accurate advice and support, essential for protecting against claims of negligence or inadequate work. Additionally, Castle Rock Insurance offers personalized solutions and exceptional customer service, helping businesses navigate complex insurance options and secure the necessary protection for their professional reputation and financial stability.