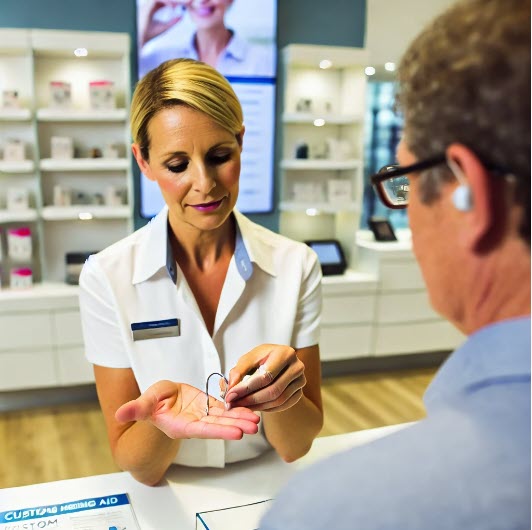

Hearing Aid Store businesses play an essential role in the Colorado community by offering specialized hearing solutions to individuals dealing with hearing impairment. These stores provide a range of products, including hearing aids, accessories, and maintenance services. Highly trained audiologists and hearing aid specialists work in these establishments to conduct hearing tests, customize hearing aids to fit individual needs, and offer ongoing support and adjustments. The invaluable service they provide enhances the quality of life for many, allowing people to stay connected and engaged with their surroundings. The presence of Hearing Aid Store businesses helps bridge the gap for those who rely on auditory devices, making them a cornerstone in health and wellness in Colorado.

Insurance is crucial for Hearing Aid Store businesses due to the various risks they encounter in their daily operations. These businesses handle expensive equipment and sensitive personal data, making them vulnerable to theft, damage, and cyber threats. On top of that, there are potential financial losses from unforeseen events like natural disasters, fire, or even accidental damage caused by employees or clients. Without appropriate insurance, a single incident could result in significant financial strain, impeding the business’s ability to function effectively. Liability issues, such as a customer suffering an injury on the premises, also pose considerable risk. As such, comprehensive insurance coverage acts as a safety net, safeguarding the business against potential financial disruptions.

Hearing Aid Store businesses in Colorado should consider several types of insurance to protect their operations comprehensively. General liability insurance is necessary to cover claims related to bodily injury or property damage that may occur on the business premises. Property insurance is equally important, providing coverage for the physical location, equipment, and inventory against losses from events like fire or theft. Product liability insurance offers protection against claims arising from defects in the hearing aids or related products sold. Additionally, businesses should look at professional liability insurance, which covers errors or negligence in professional services provided, and cyber liability insurance to safeguard against data breaches and cyberattacks. Workers’ compensation insurance is also essential, covering medical expenses and lost wages for employees injured on the job. By securing these insurance coverages, Hearing Aid Store businesses can ensure a stable operational environment, prepared to handle any unforeseen challenges.

How Much Does it Cost to Insure a Hearing Aid Store in Colorado?

The cost to insure a hearing aid store in Colorado can vary widely based on several factors, including the size of the business, the value of its inventory, and the specific types of coverage required. On average, you can expect to pay between $800 to $2,000 annually for a basic business insurance policy package that includes general liability, property insurance, and business interruption coverage. However, this range can increase depending on additional coverages such as professional liability, product liability, and employment practices liability insurance. Each of these coverages provides essential protection tailored to a hearing aid store’s unique risks, ensuring that your business can continue to operate smoothly even when unexpected events occur.

To obtain the most accurate and comprehensive insurance for your hearing aid store, it’s advisable to work with local Colorado-based insurance brokers like Castle Rock Insurance. These brokers have in-depth knowledge of the state’s regulations and the specific needs of businesses operating within Colorado. By partnering with a local broker, you can ensure that your insurance coverage is not only sufficient but also compliant with all relevant state laws. Furthermore, a local broker can assist you in comparing quotes from multiple insurers, helping you find the best coverage at the most competitive price within the $800 to $2,000 range.

Protect Your Hearing Aid Store: Get an Insurance Quote Today!

Castle Rock Insurance is highly recommended for hearing aid store business insurance due to its extensive access to over 50 commercial carriers. This vast network enables them to offer competitive quotes and tailored coverage options specific to the unique needs of hearing aid retailers in Colorado. Their deep expertise ensures comprehensive protection, from general liability to specialized equipment coverage, giving store owners peace of mind. Furthermore, Castle Rock’s dedicated team excels in providing personalized service, helping businesses navigate complex insurance landscapes. Partnering with Castle Rock guarantees that hearing aid stores receive robust, adaptable policies that safeguard their operations and assets effectively.