Building maintenance contractors in Colorado perform a variety of essential tasks to ensure that buildings remain in good working order. These services can include everything from routine cleaning, HVAC maintenance, and minor repairs to more specialized tasks like electrical work, plumbing, and landscaping. Building maintenance contractors play a crucial role in preventing small issues from becoming large, costly problems. They work in various settings, including commercial properties, residential complexes, and industrial facilities, ensuring that all systems function smoothly and environments remain safe and pleasant for occupants.

Having insurance for building maintenance contractors is important to protect against the risks and liabilities associated with their work. It is possible for contractors to accidentally cause damage to a property or for someone to get injured while they are performing their duties. In such cases, having insurance helps cover the costs of repairs, legal fees, and medical expenses, preventing financial strain on the contractor’s business. Moreover, holding appropriate insurance can enhance a contractor’s credibility and reliability, often making them a more attractive choice for clients who need assurance that any potential damages or accidents will be covered.

Building maintenance contractors in Colorado should consider several types of insurance to ensure comprehensive coverage for their business. General liability insurance covers third-party injuries and property damage, which is fundamental in this industry. Workers’ compensation insurance is also essential as it covers medical expenses and lost wages for employees who may get injured on the job. Commercial property insurance protects the contractor’s own equipment and tools, which are vital for their day-to-day operations. Additionally, having business auto insurance is important if vehicles are used to transport equipment or travel to job sites. By securing these types of insurance, building maintenance contractors can continue to provide their essential services with peace of mind.

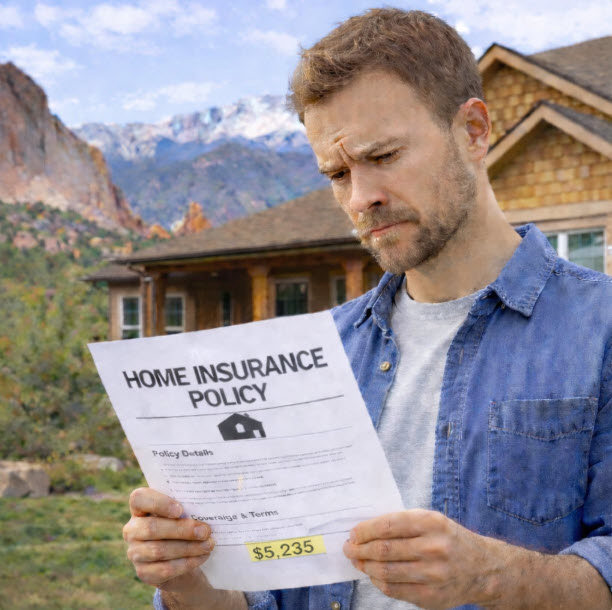

How Much Does Insurance Cost for Building Maintenance Contractors in Colorado?

The cost of insurance for building maintenance contractors in Colorado can vary significantly based on several factors such as the size of the business, the scope of services provided, and the number of employees. On average, building maintenance contractors might expect to pay anywhere from $500 to $2,500 annually for general liability insurance. This type of insurance typically covers third-party injuries, property damage, and legal fees. Additionally, workers’ compensation insurance, which is essential for businesses with employees, can cost approximately $0.75 to $2.74 per $100 of payroll. It’s crucial for contractors to have comprehensive coverage to protect their business from potential risks.

To find the best rates and tailored coverage, it is advisable for building maintenance contractors in Colorado to work with local insurance brokers who understand the specific needs of businesses in the region. One such recommended broker is Castle Rock Insurance, which specializes in providing customized insurance solutions for contractors. By consulting with a knowledgeable broker like Castle Rock Insurance, contractors can ensure they receive the most appropriate and cost-effective coverage, allowing them to focus on their work without the constant worry of potential liabilities.

Protect Your Building Maintenance Business: Get an Insurance Quote Today!

Castle Rock Insurance is highly recommended for building maintenance contractors seeking business insurance in Colorado owing to their robust coverage options and industry expertise. With access to over 50 personal and residential insurance carriers, they can tailor policies to meet the specific needs of commercial clients, ensuring optimal protection against a variety of risks. Their comprehensive offerings include liability, property, and workers’ compensation coverage, addressing the multifaceted demands of the building maintenance sector. Furthermore, Castle Rock Insurance’s dedicated team provides unparalleled support and insight, assisting businesses in navigating regulatory requirements and mitigating potential liabilities effectively. Choose Castle Rock for reassurance and comprehensive coverage tailored to your needs.