Soundproofing contractors play an essential role in improving the acoustical quality of various environments, including residential, commercial, and industrial spaces. Their work involves the installation of specialized materials and systems designed to reduce unwanted noise or enhance sound quality. Typical projects include the installation of acoustic panels, soundproof barriers, insulation, and specialized windows and doors. In addition to noise reduction, soundproofing contractors often ensure that buildings comply with acoustic regulations and standards, which is vital for both new construction and renovation projects. Their expertise is highly sought after for spaces like recording studios, theaters, offices, and homes throughout Colorado.

The Importance of Insurance for Soundproofing Contractors

Insurance is crucial for soundproofing contractors in Colorado due to the specialized and high-risk nature of their work. Whether working on large commercial projects or smaller residential installations, these contractors face several potential risks. This includes property damage, injuries to workers, and accidental damage to client properties. Additionally, soundproofing projects often require the use of complex machinery and materials, which can pose hazards. Without proper insurance, contractors may face significant financial liabilities if something goes wrong on the job.

What Types of Insurance Do Soundproofing Contractors Need?

- General Liability Insurance: This is essential for covering third-party bodily injuries or property damage that might occur during a project. For example, if a contractor accidentally damages a client’s property during installation, general liability insurance would cover the repair costs.

- Workers’ Compensation Insurance: Mandatory in Colorado for businesses with employees, this insurance covers medical expenses and lost wages if a worker is injured on the job. Soundproofing often involves working in construction sites or handling heavy materials, so workers’ compensation is critical for contractor protection.

- Equipment Insurance: Soundproofing contractors rely on specialized equipment like sound meters, drills, and soundproofing materials. Equipment insurance ensures that tools are covered in case they are damaged, lost, or stolen, allowing contractors to continue their work without delays.

- Professional Liability Insurance (Errors & Omissions): This protects against claims of negligence, mistakes, or inadequate work. For instance, if a client claims that the soundproofing installation did not meet the required acoustic standards, this insurance would help cover legal costs and potential settlements.

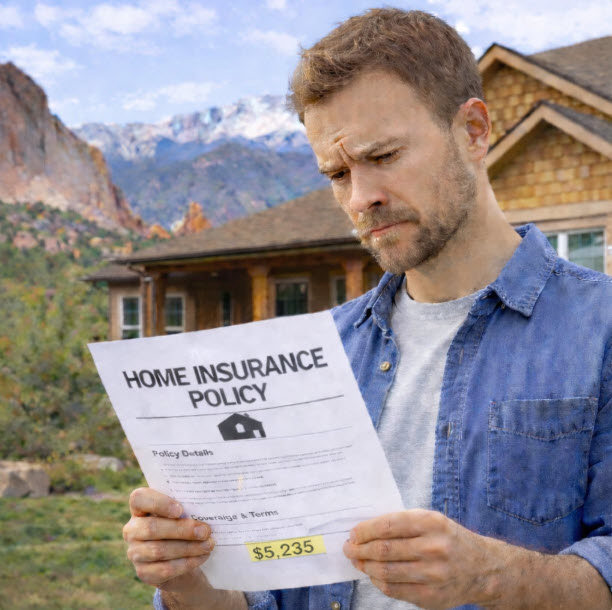

How Much Does Insurance Cost for Soundproofing Contractors in Colorado?

The cost of insurance for soundproofing contractors in Colorado depends on several factors, such as the size of the business, the scope of projects, and the contractor’s claims history. Here’s an estimated breakdown of insurance costs:

- General Liability Insurance: The average cost ranges from $500 to $1,500 per year, depending on the size of the contractor’s operations and the level of risk involved.

- Workers’ Compensation Insurance: This is required for businesses with employees and typically costs between $400 and $2,000 annually, depending on the number of employees and the risks they face on job sites.

- Professional Liability Insurance: This coverage can range from $800 to $2,500 per year, depending on the complexity of projects and the contractor’s claims history.

- Equipment Insurance: The cost varies depending on the value of tools and equipment, generally ranging from $300 to $1,000 annually.

Overall, soundproofing contractors can expect to pay between $1,500 and $5,000 annually for comprehensive insurance coverage. Larger or higher-risk operations may see premiums on the higher end, especially if additional coverages are required.

Why Work with Local Colorado-Based Insurance Brokers?

To get the most comprehensive and cost-effective insurance coverage, it’s highly recommended that soundproofing contractors work with local Colorado-based insurance brokers like Castle Rock Insurance. These brokers understand the specific risks and regulatory requirements soundproofing contractors face in Colorado. By working with local experts, contractors can secure tailored insurance policies that meet their unique needs and protect their business from potential financial risks. Castle Rock Insurance provides access to over 50 commercial insurance carriers, ensuring that contractors receive the best coverage at competitive rates.

Protect Your Soundproofing Business: Get an Insurance Quote Today!

Castle Rock Insurance is a trusted choice for soundproofing contractors in Colorado seeking comprehensive business insurance. With a deep understanding of the unique risks soundproofing contractors face, Castle Rock tailors insurance solutions to address everything from equipment damage to liability concerns. With access to over 50 personal and residential insurance carriers, they offer competitive rates and customized plans that provide optimal protection. Their expert agents ensure contractors are fully covered, allowing them to focus on delivering excellent services without the stress of potential financial setbacks. Reach out to Castle Rock Insurance today to safeguard your soundproofing business.