Architects in Colorado face various risks, from design flaws to project delays and liability issues. Without comprehensive insurance, a single mistake or claim could jeopardize your business. This makes insurance imperative for ensuring the longevity and legality of your architecture firm.

Professional Liability Insurance (Errors and Omissions) covers claims related to design flaws, project delays, or other professional mistakes that could result in financial loss for clients. This coverage helps mitigate the financial impact of legal defense costs and potential settlements, ensuring that architects can continue their practice without facing crippling financial burdens.

General Liability Insurance is crucial for covering third-party bodily injury and property damage that may occur during the course of an architect’s work. Whether it’s a client visiting the office or an accident happening at a project site, general liability insurance provides protection against unforeseen incidents. This coverage helps maintain a professional reputation and ensures that architects are prepared for any unexpected situations that may arise.

Commercial Property Insurance protects your office space, equipment, and valuable documents from risks such as fire, theft, or natural disasters.

Business Interruption Insurance provides financial support if the office needs to close temporarily due to a covered event, helping to cover ongoing expenses and lost income.

Business Owners Policy (BOP) is an ideal option for architects, combining several coverages into one comprehensive package. This approach simplifies the insurance process and ensures comprehensive protection at competitive rates.

Commercial insurance is essential for architects in Colorado, as it shields against diverse risks like design flaws, project delays, and liability issues. Comprehensive coverage prevents a single mistake or claim from jeopardizing your business. By safeguarding your investment, insurance ensures the longevity and legality of your architecture firm, providing peace of mind.

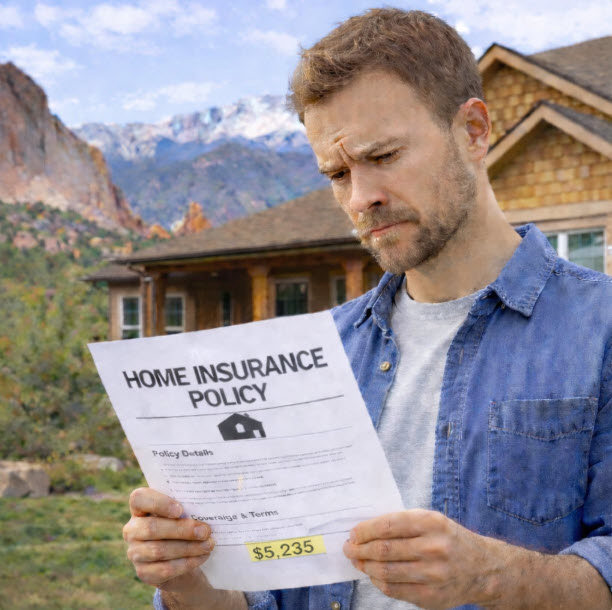

How Much Does Insurance Coverage Cost for a Colorado Architecture Business?

The cost of insurance coverage for a Colorado architecture business can vary significantly depending on factors such as the size of the firm, the scope of projects, and the types of coverage required. Professional liability insurance can range from $1,500 to $3,000 per year for small to mid-sized firms, while larger firms may see premiums ranging from $5,000 to $10,000 annually. General liability insurance typically costs between $500 and $1,500 per year, and property insurance can range from $500 to $2,000 annually. Business interruption insurance might add another $300 to $1,000.

Architects should contact Colorado-based local insurance brokers like Castle Rock Insurance to get personalized quotes and ensure they have the appropriate coverage for their specific needs. This approach provides the most accurate pricing and helps secure the best protection for their business.

Protect Your Architecture Business: Get an Insurance Quote Today!

Castle Rock Insurance is highly recommended for architecture businesses due to their expertise and personalized approach. With access to over 50 commercial carriers, they offer tailored coverage to meet the unique needs of architects. Their local, independent brokers provide unbiased advice and competitive rates. Whether it’s professional liability, general liability, or property insurance, Castle Rock Insurance delivers customized solutions that safeguard against industry-specific risks. Their commitment to exceptional service and local knowledge makes them a trusted partner for architecture firms seeking the best insurance options. seeking the best insurance options.