Electronic Store businesses in Colorado serve as vital hubs for technology enthusiasts and everyday consumers alike. They sell a variety of electronic devices, including smartphones, laptops, televisions, and household appliances, along with providing essential services like repairs and technical support. These stores play a crucial role in driving local economies by creating jobs, fostering technological literacy, and supporting the digital needs of both individuals and other businesses. Their presence in the community not only enhances access to cutting-edge technology but also facilitates a more connected and informed populace.

Insurance is essential for Electronic Store businesses in Colorado due to the multitude of risks they face. These risks include theft, fire, and water damage, which can severely impact their inventory and operational capacity. Additionally, electronic devices are high-value items, making them attractive targets for criminals. Natural disasters and accidents can also disrupt business continuity and result in significant financial losses. Without proper insurance coverage, Electronic Store businesses might find it challenging to recover from such setbacks, jeopardizing their sustainability and long-term success.

Electronic Store businesses in Colorado need specific types of insurance coverage to safeguard their operations effectively. General liability insurance is crucial to protect against claims of bodily injury or property damage that customers might experience on the premises. Commercial property insurance helps protect the physical store, including its inventory, from risks like fire, theft, and natural disasters. Business interruption insurance is also vital, as it provides financial support if the store must close temporarily due to covered events. Additionally, cyber liability insurance is becoming increasingly important to protect against data breaches and cyber-attacks. Securing these insurance coverages ensures that Electronic Store businesses can navigate risks and maintain their essential role in the community.

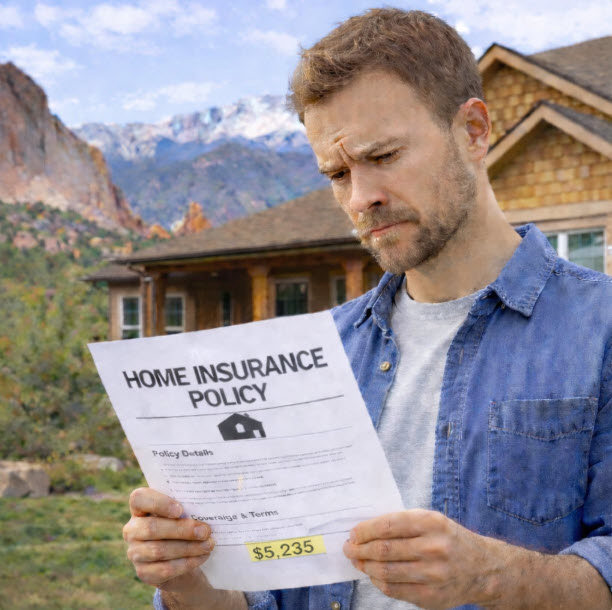

How Much Does it Cost to Insure a Electronic Store in Colorado?

Insuring an electronic store in Colorado can vary in cost depending on several factors, including the size of the store, the value of the inventory, the number of employees, and the specific risks associated with your location and business operations. On average, electronic store owners can expect to pay anywhere from $500 to $2,500 annually for a basic business owner’s policy (BOP) that typically combines general liability and property insurance. However, if you are looking for more comprehensive coverage that includes theft, cyber liability, and workers’ compensation, the costs could rise to $3,000 to $7,000 per year. It’s crucial to conduct a thorough assessment of your risks and insurance needs to determine the most appropriate coverage for your store.

For the best deals and most accurate quotes, it’s recommended to work with local Colorado-based insurance brokers like Castle Rock Insurance. These brokers have specialized knowledge of the local market and can tailor insurance packages to meet the specific needs of electronic store owners in Colorado. By partnering with a local broker, you benefit from a personalized approach and can ensure that your electronic store is adequately protected against the unique risks it faces. This not only provides peace of mind but also helps in securing the financial future of your business.

Protect Your Electronic Store: Get an Insurance Quote Today!

Castle Rock Insurance is a top recommendation for electronic store business insurance in Colorado due to their extensive access to over 50 commercial carriers. This breadth of options ensures that electronic store owners can find tailored, competitive quotes. Their specialized policies cover vital aspects such as liability, property damage, and employee protection, crucial for safeguarding against electronic goods’ unique risks. Furthermore, Castle Rock Insurance’s expert advisors are adept at customizing coverage plans to meet specific business needs, providing peace of mind and comprehensive protection. Trust Castle Rock to secure the best insurance solutions for your electronic store business in Colorado.