In the vibrant landscape of Colorado’s economy, workers’ compensation insurance emerges not merely as a legal requirement but as a cornerstone of workplace safety and employee wellness. This insurance is pivotal for both protecting employees and preserving the financial stability of businesses across the state. Under the stewardship of the Colorado Department of Labor and Employment, state laws mandate that most employers carry workers’ compensation insurance from the moment they hire their first employee. This regulation spans across various sectors, ensuring comprehensive coverage that upholds the well-being of Colorado’s diverse workforce.

Workers’ compensation insurance is essential in Colorado for several reasons. It guarantees that employees receive prompt and appropriate medical treatment for injuries or illnesses acquired in the workplace, ensuring a quicker path to recovery. By compensating for lost wages during recovery, it provides vital financial support to injured workers, allowing them to focus on healing without the stress of lost income. Beyond safeguarding employees, workers’ compensation shields businesses from potential lawsuits stemming from workplace injuries, offering peace of mind and financial security. Additionally, it underscores an employer’s commitment to a safe work environment, promoting a culture of safety and encouraging the identification and mitigation of workplace hazards.

Virtually every business in Colorado with one or more employees needs workers’ compensation insurance, whether in high-risk industries like construction and manufacturing or sectors such as retail, healthcare, and professional services. While certain categories, like independent contractors, may fall outside these requirements, misclassification can lead to severe penalties, emphasizing the need for employers to navigate these waters with care. Workers’ compensation insurance is a fundamental component of Colorado’s economic ecosystem, ensuring that the state’s workforce receives the protection and support needed to work confidently and safely. By embracing workers’ compensation, Colorado businesses not only comply with state laws but also invest in their most valuable asset—their employees. This commitment to safety and well-being is what makes Colorado a state where businesses can flourish and workers can thrive in a secure and supportive environment.

How Much Does Workers Compensation Cost in Colorado?

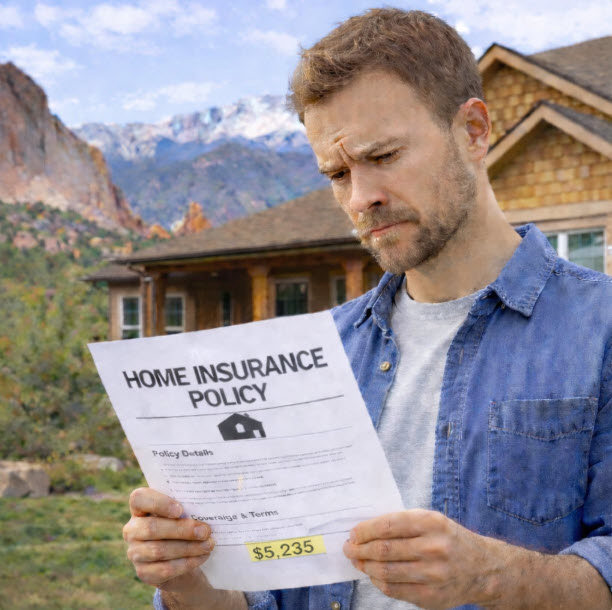

In Colorado, the cost of workers’ compensation insurance is a crucial consideration for businesses across all sectors. Premiums are tailored to the unique aspects of each company, including industry risks, employee roles, payroll size, and historical claims. Key factors influencing these costs include the risk classification of jobs, with higher-risk categories like construction incurring higher premiums than lower-risk occupations like office work. Payroll volume also affects costs, calculated per $100 of payroll, while a company’s claims history can lead to higher premiums if there are frequent claims. State guidelines set base rates for workers’ compensation, which can change based on overall claims trends within the state.

For example, a tech start-up with a small, primarily office-based team might see insurance costs from 0.1% to 0.3% of their payroll, equating to $300 to $900 annually for a $300,000 payroll. A landscaping business, due to the physical nature of the work, might face premiums ranging from 3% to 7% of payroll, costing $7,500 to $17,500 per year on a $250,000 payroll. Restaurants, with their hazardous kitchens, might pay 2% to 4% of payroll, or $8,000 to $16,000 annually for a $400,000 payroll. Construction firms could pay between 7% and 15% of payroll, with a $600,000 payroll resulting in $42,000 to $90,000 in premiums annually. Meanwhile, an accounting firm might pay 0.2% to 0.5% of payroll, totaling $1,000 to $2,500 per year on a $500,000 payroll.

Get a Workers Compensation Insurance Quote Today!

For businesses in Colorado seeking workers’ compensation insurance, Castle Rock Insurance is an excellent choice. As local Colorado-based insurance brokers, their deep understanding of the state’s regulatory landscape and insurance requirements makes them knowledgeable partners you can trust. They provide personalized service, tailoring insurance solutions to meet the unique needs of each business. With access to over 50 commercial insurance carriers, they can compare a wide range of quotes, ensuring you receive the most comprehensive coverage at competitive rates. Castle Rock Insurance’s commitment to client satisfaction and expert guidance makes them a trusted ally in securing the right workers’ compensation insurance for your business.