General Liability Insurance is essential coverage that protects businesses against a variety of common risks and liabilities. It provides financial protection for incidents involving bodily injury, property damage, and advertising injuries that occur on business premises or due to business operations. This type of insurance is crucial for covering legal fees, settlements, and medical costs arising from lawsuits. In Colorado, where businesses range from high-tech firms in Denver to adventure tourism operators in the Rockies, this coverage is especially important.

In today’s litigious society, even minor incidents can lead to expensive legal battles. General liability insurance safeguards a business’s financial health by covering unexpected expenses that could otherwise drain its resources. For instance, if a customer slips and falls on a wet floor within a business premises in Colorado, the resulting medical costs and potential legal fees could be substantial. General liability insurance ensures that such incidents don’t cause financial instability for the company. Additionally, having this insurance can enhance a business’s reputation by demonstrating to customers and partners that it is responsible and prepared to handle accidents or injuries.

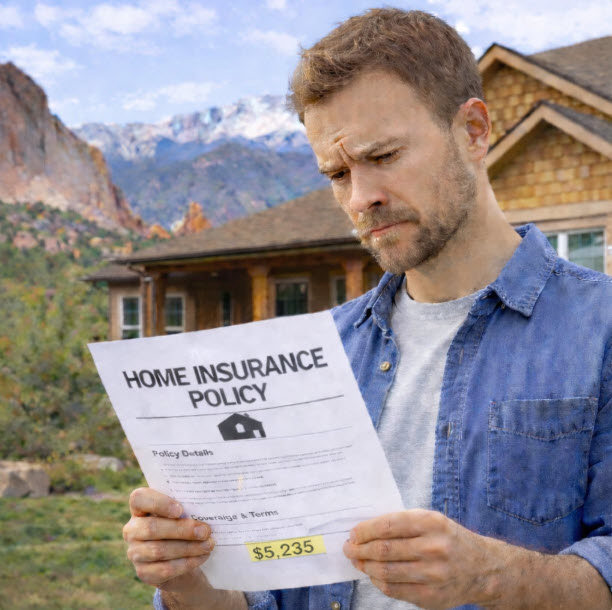

How Much Does General Liability Insurance Cost in Colorado?

The cost of general liability insurance in Colorado can vary significantly based on several factors, including the type of business, its size, location, industry-specific risks, and chosen coverage limits. For instance, a small boutique retail store in Aspen with an annual revenue of $300,000 and 3-5 employees might face premiums ranging from $600 to $1,200 annually, with coverage limits of $1 million per occurrence and $2 million aggregate. The risk factors for this business include customer foot traffic and potential slip-and-fall accidents, necessitating adequate protection despite the lower risk of severe incidents.

In contrast, an independent IT consultant in Denver with an annual revenue of $100,000, operating as a sole proprietor, might see premiums between $300 and $800 annually, with coverage limits of $1 million per occurrence and $1 million aggregate. The primary risks here involve third-party data loss or damage, resulting in lower premiums due to reduced physical risk factors. On the higher end, a construction company in Colorado Springs with $5 million in annual revenue and 50 employees could face premiums ranging from $2,500 to $10,000 or more annually, with coverage limits of $1 million per occurrence and $3 million aggregate. The high-risk nature of construction work, including the use of heavy machinery and potential for property damage and bodily injury, justifies these higher premiums.

These hypothetical examples illustrate the importance of Colorado businesses carefully evaluating their specific needs and risks when selecting general liability insurance to ensure adequate protection. By understanding how factors such as business type, size, and industry risks influence insurance costs, businesses can make more informed decisions and secure the necessary coverage to safeguard their financial health and reputation.

Protect Your Business: Get a General Liability Insurance Quote Today!

Castle Rock Insurance is recommended for Colorado businesses seeking general liability insurance due to their local expertise and personalized service. They understand the unique risks across various industries, from retail stores in Aspen to IT consultants in Denver and construction companies in Colorado Springs. With access to 50+ commercial carriers, Castle Rock Insurance offers tailored coverage options for comprehensive protection. Their knowledgeable brokers guide businesses through the complexities of insurance, securing optimal coverage at competitive rates. This ensures peace of mind against potential liabilities and financial uncertainties.