Business Income Insurance, also known as Business Interruption Insurance, is a critical safeguard for various organizations operating in Colorado’s diverse economic landscape. This coverage helps businesses manage the loss of income they might suffer due to a temporary shutdown caused by covered perils, such as natural disasters, fire, or other significant disruptions. In a state like Colorado, where weather conditions can be unpredictable and industries are varied, many organizations find this insurance not just beneficial but essential.

Retail businesses, from bustling shopping centers in Denver to quaint boutiques in mountain towns, are particularly vulnerable to disruptions. Severe weather events like snowstorms or wildfires can temporarily halt business operations, leading to a significant loss of income. Business Income Insurance allows these retail businesses to cover ongoing expenses, such as rent and payroll, ensuring they can bounce back after an unexpected closure. The state’s thriving tourism industry, including hotels, resorts, and recreational facilities, relies heavily on continuous operation to generate revenue. Events like landslides or floods, especially in tourist-heavy areas like Aspen or Vail, can severely impact their income. This insurance supports these businesses by covering lost income during repairs, helping maintain financial stability.

Manufacturing companies in Colorado face risks from equipment breakdowns or supply chain disruptions that can halt production lines. Business Income Insurance is crucial for these organizations, providing financial assistance to cover lost income and fixed costs during periods of unexpected downtime, ensuring they can resume operations smoothly once issues are resolved. Service providers, from IT services in Boulder’s tech hubs to healthcare facilities across the state, depend on uninterrupted operation to serve their clients. Business Income Insurance helps cover the lost income and operational expenses when they’re forced to suspend services due to covered damages to their physical premises or essential equipment. Colorado’s agriculture sector can be hit hard by unpredictable weather, damaging crops and equipment. Business Income Insurance assists in covering lost income during the recovery period, helping these businesses sustain until they can return to full operation.

Business Income Insurance is indispensable across a broad spectrum of industries in Colorado. It provides a financial safety net that helps ensure businesses can withstand and recover from unexpected disruptions, maintaining their financial health and supporting the stability of the state’s economy.

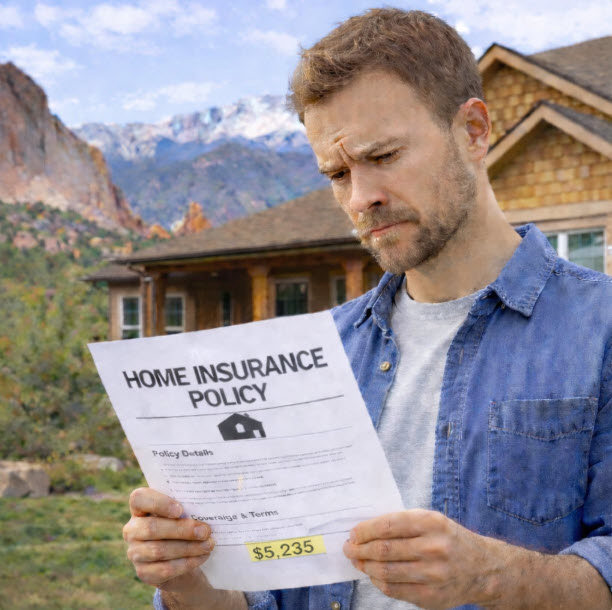

How Much Does Business Income Insurance Cost in Colorado?

Estimating the costs for Business Income Insurance in Colorado involves analyzing factors such as business type, location, annual revenue, specific risks, and desired coverage amount. This insurance is crucial for maintaining financial stability during unexpected interruptions.

Premiums for Business Income Insurance are often calculated as a fraction of the business’s property insurance premium or bundled within a comprehensive package. For example, a boutique retail store in Boulder with $300,000 in annual revenue may face risks like weather-induced closures and minor fires. The Business Income Insurance for such a store might cost about 0.75% to 1.5% of its property insurance premium. If the store’s annual property insurance is $8,000, the Business Income Insurance could add approximately $60 to $120 to its expenses. For larger businesses, such as an industrial machinery manufacturer in Colorado Springs with $30 million in annual revenue, risks like equipment malfunctions could lead to Business Income Insurance costs between 1.5% and 3% of its $75,000 property insurance premium, adding $1,125 to $2,250.

These hypothetical scenarios illustrate the variability in Business Income Insurance costs based on specific circumstances and risk exposure. It is important to consult with a Colorado-based independent insurance broker like Castle Rock Insurance to determine your unique needs and secure appropriate coverage that aligns with your operational risks and financial goals.

Protect Your Business: Get A Business Income Insurance Quote Today!

As a local and independent insurance broker with access to over 50 commercial insurance carriers, Castle Rock Insurance is an ideal partner for Colorado businesses seeking Business Income Insurance. Their extensive network allows them to create tailored insurance solutions that address the unique needs and risks of diverse clients, from boutique stores in Boulder to tech companies in Denver and resorts in Aspen. Their local presence provides a deep understanding of Colorado’s specific challenges, while their independence ensures that client interests come first. With Castle Rock Insurance, businesses benefit from competitive pricing, comprehensive coverage, and a commitment to protecting financial stability against unforeseen disruptions.