How Much Does General Contractor Liability Insurance Cost in Colorado?

The cost of general contractor liability insurance in Colorado is influenced by a complex interplay of factors, leading to a wide range of potential premiums. For small to medium-sized general contracting businesses, the annual cost for a policy offering $1 million coverage per occurrence might start from around $700 and can go up to $2,000. This range is indicative of basic coverage suited for contractors with moderate risk profiles engaging in residential or small-scale commercial projects.

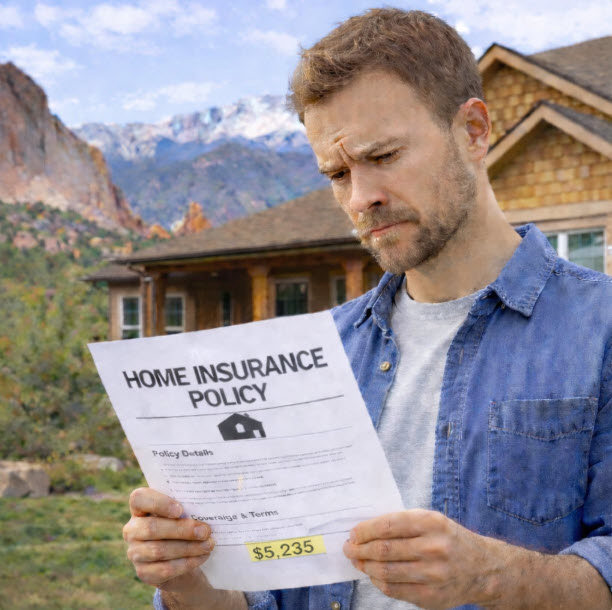

For general contractors involved in larger, more complex, or inherently riskier projects—such as high-rise construction, heavy civil infrastructure, or specialized industrial work—the cost of liability insurance can significantly increase. Premiums for these contractors can easily surpass $5,000 annually, reflecting the heightened risk and potential for costly claims associated with these types of projects.

Key determinants of these costs include the specific nature of the construction work, the contractor’s annual revenue, workforce size, and their history of claims or accidents. Specialized contractors in high-risk fields like roofing or structural engineering might see premiums on the higher end of the spectrum due to the increased likelihood of incidents leading to claims.

Further customization of the policy through added endorsements or higher coverage limits can also adjust the premium. For example, opting for a $2 million coverage limit or adding professional liability coverage can raise the insurance cost but provide more extensive protection.

Get A Quote

Castle Rock Insurance presents an excellent option for general contractors seeking liability insurance in Colorado. With access to over 50+ commercial insurance carriers, they offer unparalleled flexibility and diversity in coverage options. This extensive network allows Castle Rock to tailor insurance solutions that precisely meet the specific needs of general contractors, ensuring comprehensive protection against the myriad risks they face. Their expertise in navigating the complexities of the construction industry and understanding of Colorado’s unique regulatory landscape enables them to provide personalized advice and competitive quotes. By choosing Castle Rock Insurance, general contractors can secure robust liability coverage that supports their business’s growth and stability.