Castle Rock Insurance proudly serves the residents of Red Cliff, offering a comprehensive range of insurance options tailored to this unique mountain community. As independent brokers, Castle Rock Insurance partners with top carriers to ensure Red Cliff residents have access to diverse and personalized coverage. Nestled in the heart of the Rocky Mountains at an elevation of 8,500 feet, Red Cliff is a peaceful town with a population of around 300 residents. Known for its stunning mountain views and proximity to Vail, Red Cliff offers a serene environment for those seeking a tranquil escape with easy access to world-class outdoor recreation. The town’s primary ZIP code, 81649, is surrounded by the White River National Forest, providing abundant opportunities for hiking, fishing, and skiing, all just a short distance from the renowned Vail ski resort.

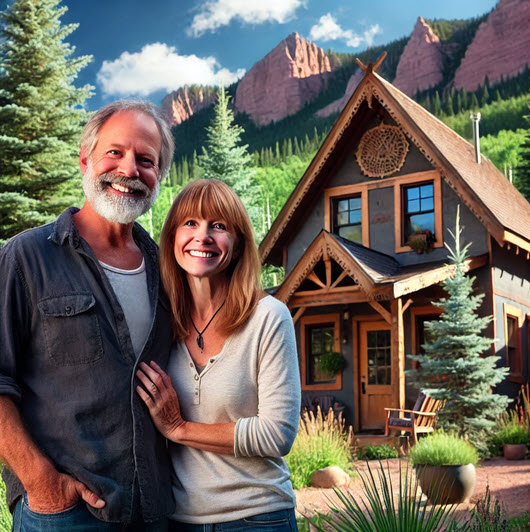

The housing market in Red Cliff consists primarily of single-family homes and cabins, many of which are tucked away in the natural surroundings and offer breathtaking views of the surrounding mountains and valleys. Red Cliff’s homes are often on larger lots, offering residents a more rural lifestyle while still being close to the amenities of Vail. Known for its laid-back, community-oriented atmosphere, Red Cliff fosters a sense of camaraderie among residents. With its natural beauty and proximity to outdoor adventure, Red Cliff is the perfect destination for those seeking peace and adventure in the heart of the Rockies.

Insurance Options in Red Cliff

Castle Rock Insurance proudly serves the residents of Red Cliff with a full range of insurance options, providing the peace of mind and security that only a trusted local broker can offer. As an independent broker, Castle Rock Insurance partners with some of the nation’s leading carriers, including Safeco, Liberty Mutual, Progressive, and Nationwide, to offer a variety of coverage choices. From homeowners and renters insurance to auto and other essential types of policies, Castle Rock Insurance works diligently to ensure that Red Cliff residents receive comprehensive protection tailored to their unique needs.

One of the biggest advantages Castle Rock Insurance brings to Red Cliff is its ability to compare policies across multiple carriers. This means that instead of being limited to one insurance provider, residents have access to a broad selection of policies, allowing Castle Rock Insurance to match them with the best coverage at the most competitive rates. The team takes the time to understand the specifics of each client’s situation, ensuring that every policy is well-suited to the individual, family, or business it serves.

How Much Does Insurance Cost in Red Cliff?

Insurance costs in Red Cliff can vary based on property type, location, and the level of coverage needed. Due to the area’s mountainous setting and potential for severe weather, such as snowstorms and hail, insurance premiums may be slightly higher than in flatter, more urban areas. Castle Rock Insurance provides customized insurance solutions and personalized quotes for Red Cliff residents by comparing multiple carriers. Below are typical costs for popular types of insurance policies, with factors that influence premiums, including options for fire zone, flood, and rural property coverage:

- Auto Insurance: $500 – $800 per year

Auto insurance rates in Red Cliff are influenced by factors such as driving history, vehicle type, and the mountainous terrain that can affect driving conditions. Clean driving records often yield lower premiums, while newer or high-value vehicles may increase costs. - Home Insurance: $1,000 – $1,500 per year

Home insurance costs depend on the home’s value, age, and location. Properties in areas with heavy snow accumulation, wildfire risks, or other mountain-specific hazards may have higher premiums. Castle Rock Insurance helps residents find affordable policies, including fire zone insurance to protect homes in high-risk areas. - Renters Insurance: $150 – $250 per year

Renters insurance in Red Cliff provides coverage for personal belongings and liability protection. Costs vary based on property coverage amounts, deductible levels, and additional liability needs. - Condominium Insurance: $300 – $500 per year

Condominium insurance covers personal property, liability, and portions not covered by the condo association’s master policy. Costs depend on individual coverage needs, including add-ons for high-value items. - High-Value Home Insurance: $2,500 – $4,500 per year

For high-value homes in Red Cliff, premiums vary significantly based on custom coverage, security features, and location. Castle Rock Insurance specializes in policies for unique or high-value properties, ensuring optimal coverage for luxury homes, including fire zone protection as needed.

Castle Rock Insurance understands the unique needs of Red Cliff residents, including rural, fire zone, and flood coverage, and offers tailored insurance options by comparing multiple carriers. With local expertise, Castle Rock Insurance ensures that Red Cliff residents receive the best coverage and competitive rates suited to their individual needs.

Get an Insurance Quote to Stay Protected in Red Cliff

Castle Rock Insurance is the trusted choice for residents of Red Cliff, offering affordable, customized insurance solutions. As a local, independent broker, Castle Rock Insurance partners with over 20 carriers to provide the best coverage options for the community. Discounts for bundling, mature drivers, and homes with advanced security systems ensure that Red Cliff residents get comprehensive coverage at the best value.