As we move into 2026, homeowners insurance in Colorado looks very different than it did just a few years ago. Rising costs are now part of the new normal and insurance pricing across the state reflects long-term changes rather than temporary market swings. Homeowners should expect insurance to remain an important household expense that benefits from regular review and planning.

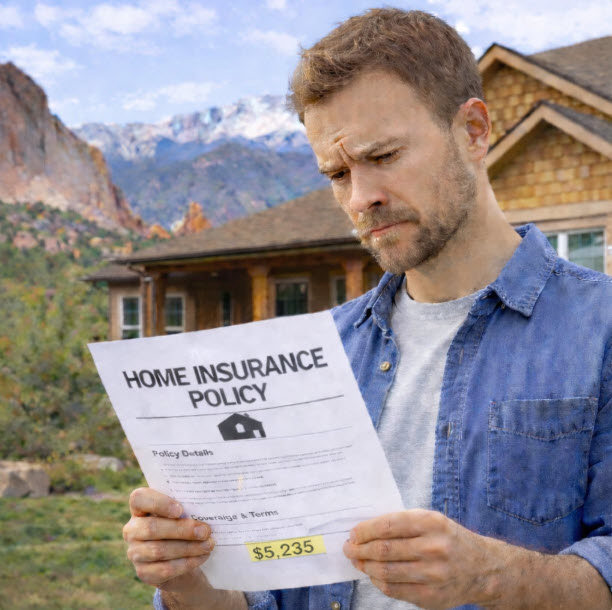

In 2026, the average Colorado homeowner can expect to pay approximately $4,200 to $5,200 per year for homeowners insurance, depending on the home’s value, location, and overall risk profile. These higher costs are driven by ongoing wildfire exposure, frequent hail and wind losses, rising rebuild costs and tighter underwriting guidelines. For many Front Range and foothill communities, homeowners insurance has become something to actively manage, similar to property taxes or long-term home maintenance.

Homeowners should also expect continued pressure from higher rebuilding costs and weather-related losses. Construction materials, skilled labor and updated building requirements have increased the cost to repair or rebuild a home after a loss, which directly affects insurance premiums. Wildfires, hailstorms, wind damage and localized flooding are now evaluated over long periods of time rather than as isolated events, leading to higher base rates and fewer carrier options in some areas. Even homeowners with no claims history may see increases in 2026 as insurers adjust pricing across entire regions based on long-term risk trends.

How Much Does Colorado Home Insurance Cost for High-Risk Fire Zones?

Homeowners insurance is more expensive in high-risk fire zones than it is for similar homes in lower-risk parts of Colorado. In 2026, it is common to see annual premiums fall in the range of $6,500 to $15,000+, depending on the home’s replacement cost, location, access and surrounding wildfire exposure. Homes with higher rebuild values, limited road access, steep terrain or dense vegetation tend to land toward the higher end of that range. Even well-maintained properties with no claims history often face higher pricing because wildfire risk is evaluated across regions and structures, not just individual loss records. Compared to the statewide average, fire-zone homes almost always carry higher base rates, larger deductibles and fewer carrier options.

A major reason for these higher costs is the growing use of excess and surplus carriers in wildfire-exposed areas. When standard insurers decline or restrict coverage, E&S markets are often the remaining option. These policies typically come with higher premiums, larger wildfire deductibles and more restrictive terms. Standard carriers that still insure homes in fire zones are becoming more selective and place heavy weight on roof age, roof material or composite rating and documented fire mitigation. Older roofs or non-impact-rated materials can push a home out of the standard market even if the property is otherwise well maintained. In many cases, wildfire exposure does not just raise the price of insurance. It determines which carriers will offer coverage at all and how that coverage is structured.

How Homeowners Insurance Is Expected to Change in 2026

2026 is likely to feel more stable than the past few years but also more rigid. The rapid premium jumps and sudden carrier exits that surprised many homeowners are becoming less common. Instead, insurance companies are settling into clearer rules and long-term pricing models. This means fewer shock increases for some households but also less flexibility overall. Homeowners should expect more consistency from year to year but fewer exceptions when something falls outside a carrier’s guidelines.

On the challenging side, carriers will continue to tighten underwriting in 2026. Roof age and roof condition will remain major decision points, especially in hail-prone areas. Exterior inspections and drone reports are becoming routine. Wind and hail deductibles may be higher and more commonly applied based on ZIP code or construction type. In wildfire-exposed areas, coverage may still be available but often with higher deductibles or reduced options. Some homeowners may see non-renewals or eligibility changes even without claims as carriers limit exposure in certain regions. Replacement cost reviews will also be more common, which can increase coverage limits and premiums at renewal.

The positive side of 2026 is that proactive homeowners may see better results than they did during the most volatile years. Insurance companies are paying closer attention to risk reduction and home quality. Updated roofs, improved systems, monitored alarms, defensible space and good maintenance records can make a real difference. Bundling home and auto remains one of the strongest ways to improve pricing and eligibility. Carriers are also clearer about who they want to insure, which makes the process more predictable. Homeowners who review coverage early and work with a knowledgeable broker often have more options and fewer surprises.

How Colorado Homeowners Can Save Money on Insurance Premiums in 2026

Even with higher baseline premiums, Colorado homeowners still have ways to control insurance costs in 2026. The biggest shift is that savings now come less from shopping randomly and more from being intentional. Insurance companies are rewarding lower risk, better documentation, and well-structured policies more than they did in the past.

One of the most effective ways to save remains bundling home and auto insurance with the same carrier. Many insurers strongly prefer multi-policy households, especially in higher-risk areas and bundling can improve both pricing and eligibility. Deductible choices also matter more in 2026. Higher wind and hail deductibles are becoming common, but homeowners who understand these deductibles and select levels that make sense for their finances can often lower annual premiums meaningfully.

Home improvements can also have a direct impact. Updated or impact-resistant roofing, newer electrical and plumbing systems, monitored security systems and wildfire mitigation steps such as defensible space can all help reduce costs or open access to better carriers. Just as important is documentation. Providing proof of updates, permits and maintenance upfront often leads to better results than waiting for an inspection after the quote process begins.

Finally, regular policy reviews are critical in 2026. Many homeowners are paying more simply because their coverage has not been restructured as rebuild costs, underwriting rules and carrier appetites have changed. Working with an independent broker who understands Colorado-specific risks can help identify coverage adjustments, carrier changes or pricing opportunities that may not be obvious. While no strategy can eliminate rising premiums entirely, homeowners who stay proactive and informed are far more likely to keep costs under control while maintaining strong protection.

Get a Homeowners Insurance Quote From Local Experts

Homeowners insurance in Colorado has become more complex, but finding the right coverage does not have to be. Getting a professional review of your options can help you understand what you are paying for, where there may be opportunities to save and whether your coverage still fits your home and risk profile.

Castle Rock Insurance works with independent insurance brokers and trusted carrier partners across Colorado. Because we are independent, we are not limited to a single insurance company or product. This allows us to compare coverage options, pricing, deductibles and underwriting guidelines from many insurers to find the best fit for your situation.

Whether you are renewing, shopping for better pricing, or simply want a second opinion, our team can help you navigate today’s insurance market with clarity and confidence. Contact Castle Rock Insurance today to get a free homeowners insurance quote and see how having real options can make a difference.