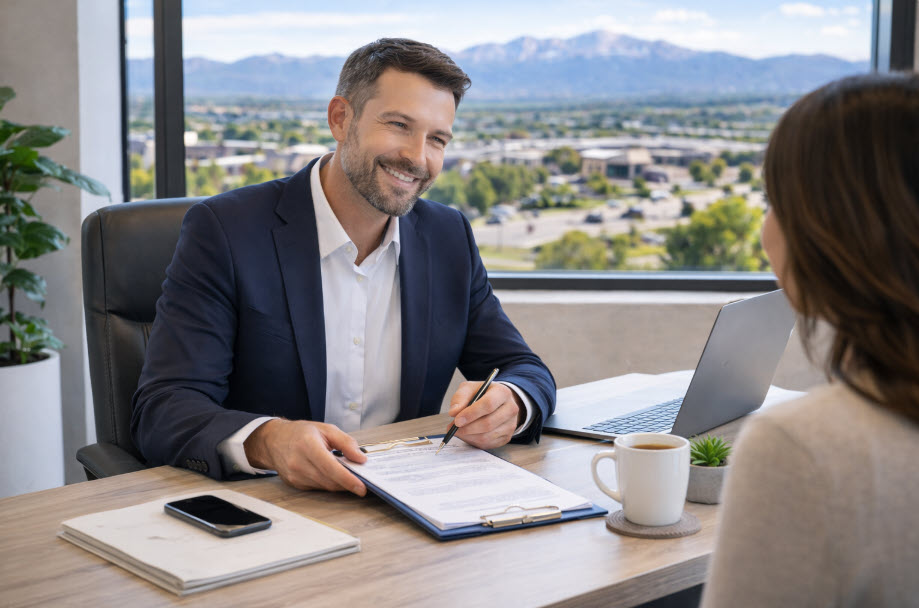

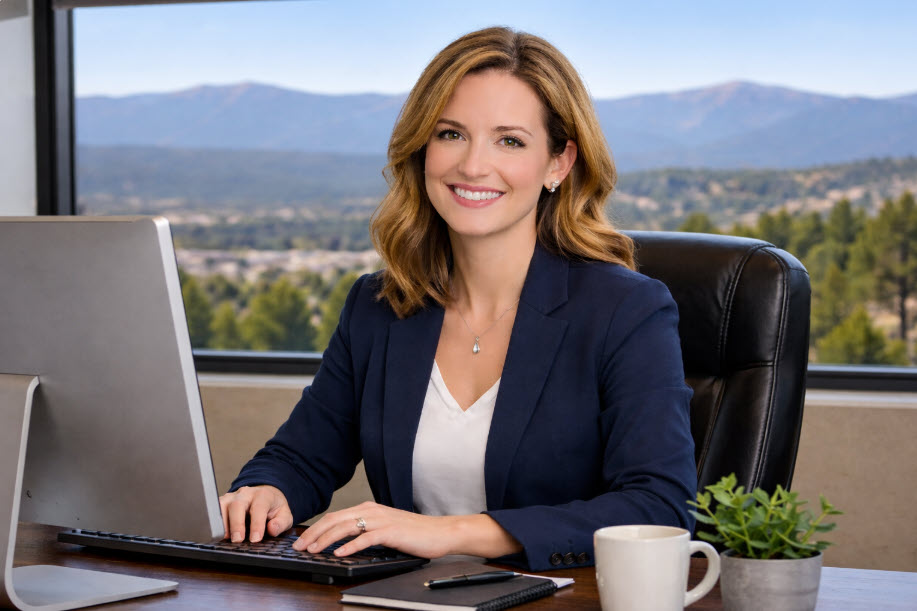

Our Journey and Mission

Castle Rock Insurance LLC is owned and operated by a Colorado licensed insurance producer serving homeowners, drivers and businesses across the state. We work closely with brokers and independent insurance agents who represent multiple personal and commercial insurance carriers. This approach allows you to compare accurate quotes and choose the best coverage option for your insurance needs while protecting your family, business, assets and livelihood.